Nutmeg: From the few to the many

Launched in 2012 by former banker Nick Hungerford, Nutmeg are a UK based online wealth manager. Their mission is to open up the murky world of financial investment, usually the preserve of the old and wealthy, to everybody, regardless of the size of the investment.

Nutmeg have experienced 400% year-on-year-growth in 2015 and their mission hasn't gone unnoticed either with the FCA recently highlighting their role in bringing transparency to the industry.

The Challenger Project caught up with founder and CEO Nick Hungerford and Head of UX Jono Hey at Nutmeg's offices in Lambeth.

“Nutmeg is democratiser; we’re bringing something that was previously only available to the very wealthy, and making it available to everyone.”

What did you see as the opportunity for Nutmeg?

Nick Hungerford: Historically wealth management has been quite an ironic market place. You had people with lots of money being given help by experts and then people with little amounts of money being given no help at all. There was no offering for these people to manage money in an institutional and smart way.

So what we’ve tried to do is bring those policies and procedures to everybody. We’re allowing consumers to be able to see their money on line, all the time, with total transparency. That is a challenger category.

We’re very much hoping that there will be new companies who come into our category. I'm sure that agencies and experts like yourself would say to us, you need more people in that category to make it a well-trodden path for more people to understand what you do. So we're looking for the future of wealth management to be one where it is democratised, and where people say, I don’t just have to focus my time on looking after the very wealthy people.

“We’re attracting people who are not investing and putting it off, just as much as we’re attracting the existing investors in this space.”

What are you challenging about the current finance industry?

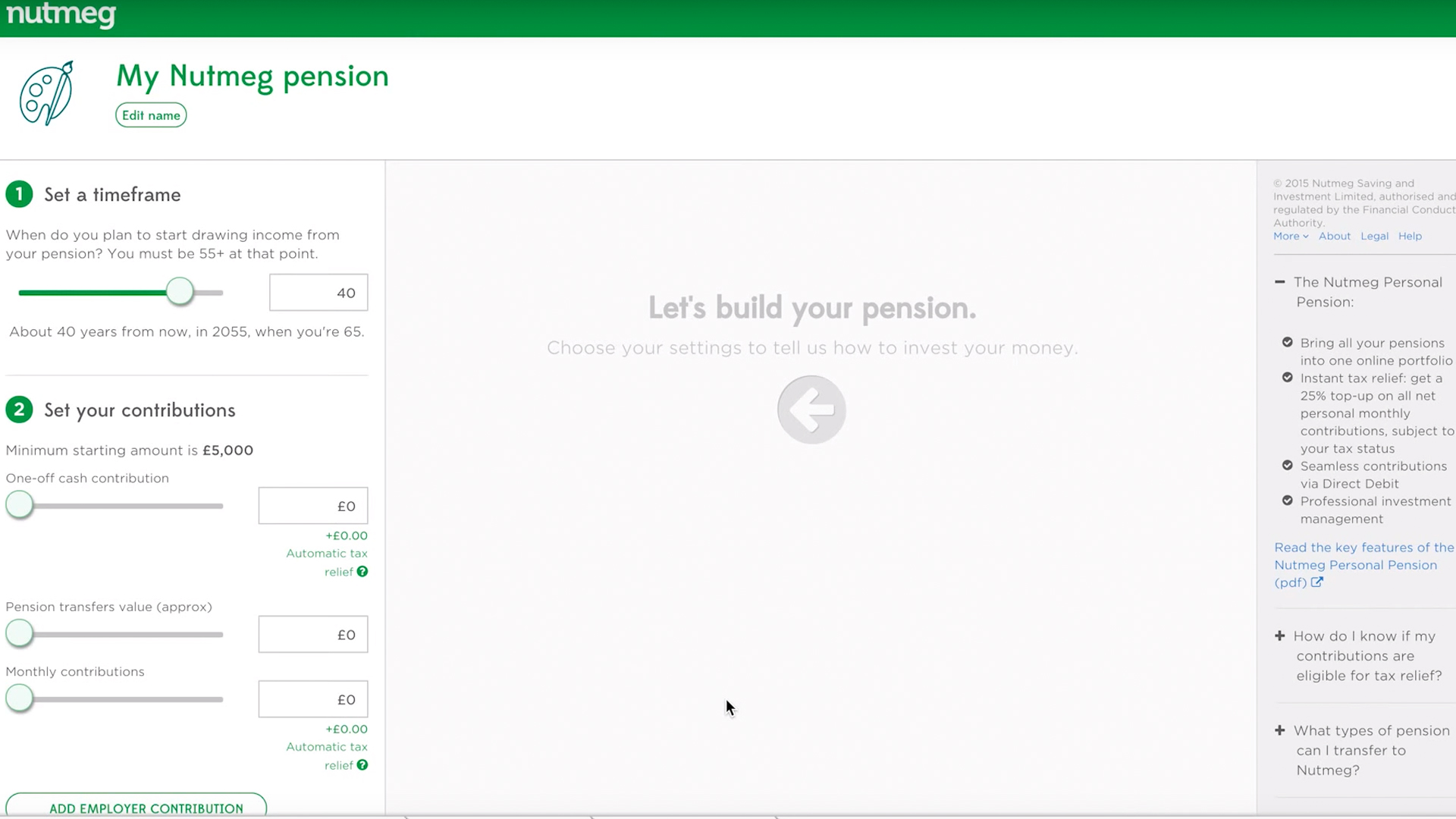

Jono Hey: The main thing we’re offering is transparency. People really struggle to get hold of simple things such as how much have I paid for managing my money. Be it if it’s a financial advisor, you get a statement once a year and it has some things on it that you may or may not understand. So what we say is, here it is. If you want to see what you’ve got, you can see it right now, at any time.

We want to simplify the process from others in the industry and make it easy to invest. We’re actually attracting people who are not investing and putting it off, just as much as we’re attracting the existing investors in this space.

“We don’t hide behind the constraint of language, but instead use it as an opportunity to educate people.”

What constraints have you encountered?

Jono Hey: Finance is an interesting place where we have all sorts of constraints. You have technical constraints, resource constraints, but you also have regulatory constraints. I've never perhaps worked in an industry that has more regulation around it. For example, there are constraints in the language that you can use. You have to talk about things in a certain way. And for us the opportunity there is to embrace that.

The regulator requires us to use certain language, but what we do is go one step further and really make sure people understand it. We don’t hide behind the constraints, but instead use it as an opportunity to educate people.

As a result, people who get to the end of the process find they have learned something along the way. And people appreciate you for that. I believe it is a great strength of ours.

What’s your approach to in-house vs. outsourcing?

Jono Hey: Our way of doing things is to focus on what we're good at, and our area of expertise. And if there's a way that you can plug into an existing service and it's going to do stuff better than you, and if that's what they do every day, then we try and do that.

How we deal with our payments is a good example to illustrate this. We've got some significant improvements to our payments coming out. And the answer is, we can build our own payment system but you know what, that's not what we're here for. What we want to find out the best people who do card payments and direct debits and leverage everything they have and plug that into our system.

So everywhere that you have the opportunity to go, these are the people who do this best. We don't need to focus on that, because that's not our core offering. How can we use their service? That's what we try and do.

What’s important from a design perspective for you?

Jono Hey: Firstly, we make sure that we keep it simple; we cut steps wherever we can and have the site as simple and user friendly as possible. We didn’t want news, data and charts like our competitors do, as these scare people. Relevance is also important, so we offer what we call goal-based investing. We try to make sure that whenever we’re managing money, we’re doing it in an intelligent, smart, and low cost way. Lastly and most importantly when we’re designing, it’s about empathy and how do you build that empathy.

“We’re always conscious that no detail is too small because fundamentally for us, it’s all about trust.”

Why are the small things important at Nutmeg?

Jono Hey: We’re always conscious that no detail is too small because fundamentally for us, it's all about trust. We need people to trust us with managing their money for their future.

For example, there is a small thing called a favicon, that probably not too many people know about. But it's one of these things that you see and experience every day when you're browsing the Web. In the top of your browser there is a little 16x16 pixel icon, which you can choose if you want to, to put your own brand in.

It's one of these things that if it’s there you don't really pay any attention to it, but if it's not there, you think something's up with this site. I don't really trust it perhaps, and I don't quite know why. So every time we have an opportunity to help reinforce trust, we always do, to show that we're paying attention at even the smallest levels. As then you're probably going to project that trust on to the other things that we do. If we're paying attention to that, people can assume we are also paying attention to all the other things that matter.

“We’d love for people to say in five years from now, you know what, I can do this on my own now.”

What does success look like for Nutmeg?

Nick Hungerford: We’d love for people to say in five years from now, you know what, I can do this on my own now. We have given them the education and learnings to be self-sufficient.

#3BitsofAdvice

Jono Hey on creating a great user experience.

1. Do the right thing. Whenever you have the opportunity and you are debating which one to choose, always question what is the right thing for your customer.

2. Always to listen and act on data. I ultimately believe you can’t design right unless you’re spending time listening and taking that data to share with your team.

3. Keep things simple. So keeping things simple obviously has benefits from a customer perspective. I have learned increasingly the longer I work in design in all forms, the benefits of simplicity translated at all levels.